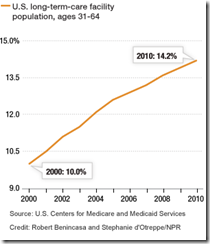

One of the main reasons cited for this movement of younger people into nursing homes are the budget cuts most states face in Medicare and Medicaid. In the long term, it is more cost efficient to care for a younger person in their home with part time caretakers. However, in the short term, this is a more expensive way of treating patients, as the caregivers need to be hired and trained. In the budget crunch most states are experiencing, short term funding takes priority over long term spending. Younger people are being moved into nursing homes earlier, as in the short term, this is a more economically viable way of treating them.

According to a study by the AARP Public Policy Institute, the cost of at home care is about a third the cost of providing care in a nursing home or institution. Many states, however, simply do not have the funding for at home care in their Medicaid programs.

One of the most telling quotes about the movement of younger people to nursing homes is:

“Over the past 20 years, federal laws and policies have established a civil right to get long-term care at home. But NPR's investigation found that is only sporadically enforced.

More than 60 percent of what states spend on long-term care for the elderly and disabled goes to pay for people — like Michelle Fridley — to live in a nursing home. The amount spent on home-based care has grown steadily, but not nearly enough to meet the need. Nationwide, there are some 400,000 people on state waiting lists for home-based care, double the number 10 years ago.”

Frequently attorney’s like our firm, that specialize in caring for the elderly, and those that have long term care needs, must be engaged to support a patient’s right to at home care. In 1999, the right to at home care was clearly established in the Supreme Court, in the “Olmstead Case”. In that decision, the Supreme Court stated that the unnecessary institutionalization of people with disabilities is a form of discrimination.

To be continued…